The Super-App Blueprint: Collapsing the Divide Between Social, Banking, and Crypto

From Robinhood, X to Coinbase, the race to embed finance, identity, and commerce into unified ecosystems is redefining consumer engagement and competitive moats.

Hey there,

This is a free edition of Venturebloxx’s newsletter, your regular dose of blockchain and AI insights for business leaders, strategists, innovation officers, investors, decision-makers, and founders looking to future-proof their organizations and unlock real-world value through emerging tech.

Once a proven model in Asia, think WeChat and Alipay, the super-app concept is now sweeping globally. Today, it binds payments, banking, investments, crypto, social, and commerce into unified experiences.

Emerging Markets (Africa, LatAm, SE Asia): Mobile-first, low desktop banking usage drives adoption of integrated financial apps.

Developed Markets (US/EU): Consumers expect fewer apps and more seamless capabilities. Neobanks, crypto platforms, and tech super-apps reflect this shift.

Tech & Regulation: Open banking, API economies, AI personalization, plus crypto-native primitives, are enabling super-app innovation.

The takeaway: Whoever controls a multi-service financial ecosystem gains not just transactions. They gain user habits, data, and loyalty.

Crypto-Enabled Super-Apps: Who’s Leading?

Elon Musk’s X (formerly Twitter)

X Money, backed with a Visa partnership, is already in beta, offering peer-to-peer transfers, tipping, and linking bank accounts. It holds 41 U.S. state money transmitter licenses and is FinCEN-registered.

X plans to roll out investing, trading, and credit/debit cards, embedding full financial services inside its social feed.

With 600 million users as of March 2025, X’s rollout is a landmark moment in Western financial super-app competition.

Coinbase

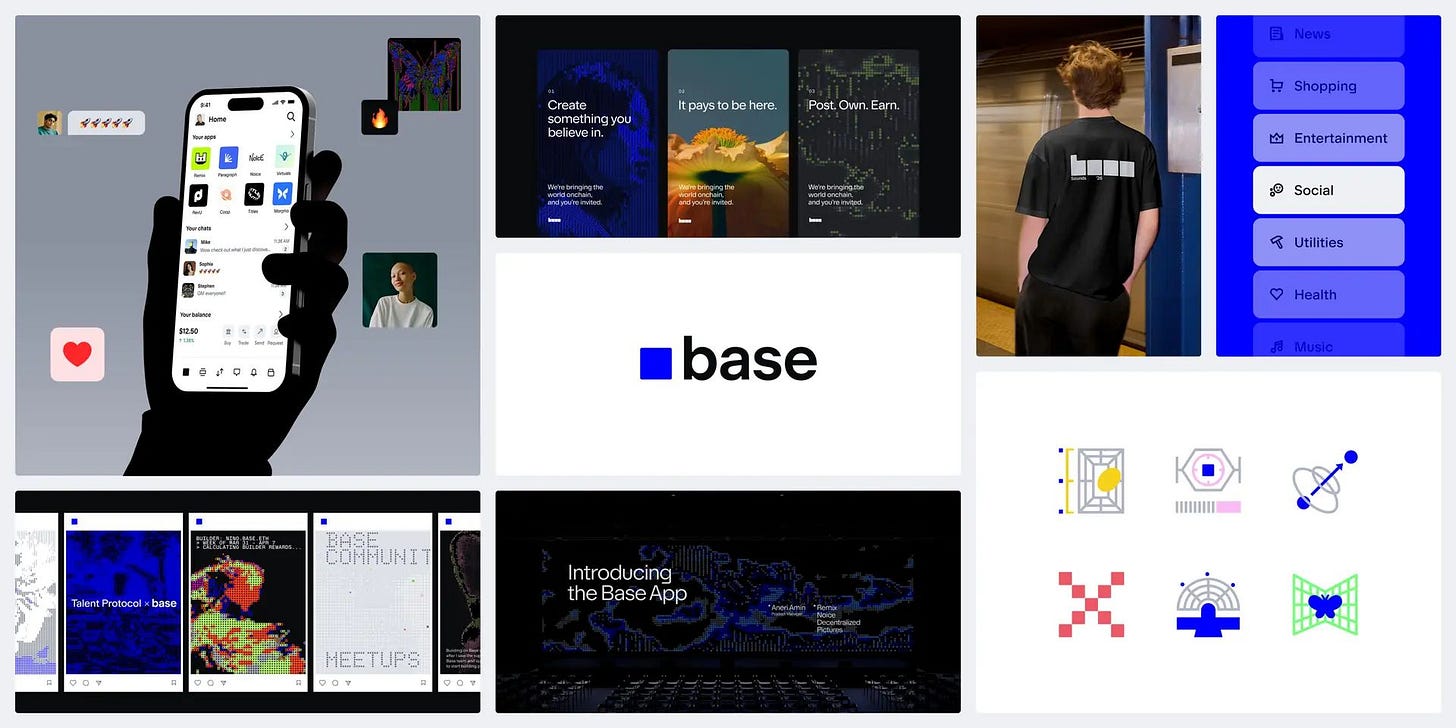

Coinbase is now openly chasing the super-app vision, building a platform that fuses identity, commerce, financial services, and social functionality around USDC-powered infrastructure and Base, its Layer 2 Ethereum scaling solution.

According to CEO Brian Armstrong, the ambition is to become a “financial OS” that moves beyond just trading. Their new app experience, dubbed the “everything app”, includes:

DeFi access, supporting massive coin listings, staking, and token transfers

Built-in identity and reputation layers via Base

Mini-app architecture, allowing external developers to build on Base while leveraging Coinbase’s trust and compliance rails

Commerce functionality: Integrated stablecoin payments for merchants and creators

Messaging and on-chain social elements inspired by Farcaster and Lens

Smart wallet infrastructure enabling seamless onboarding for crypto newcomers

A July 2025 Base relaunch branded this as “A New Day One,” signaling a pivot from protocol-building to consumer-scale infrastructure, positioning Coinbase as the U.S. equivalent of Alipay. More

CEO Brian Armstrong has publicly stated Coinbase’s goal is to resemble WeChat/Alipay by layering payments, DeFi, social NFTs, identity, and mini-apps on top of core exchange features.

Robinhood

Launched tokenized U.S. stock & ETF tokens for EU customers, enabling 24/5 trading, dividends, and Arrow-based Layer-2 plans, plus the pending release of their own chain.

U.S. users now see ETH & SOL staking, crypto rewards via a credit card, and perpetual futures trading.

This positions Robinhood as a comprehensive blockchain-native finance platform with global ambition.

We are going to release our flagship report. Want to get your or your portfolio companies in front of 20k+ business leaders? 👉 Reach out.

Venturebloxx helps you position and elevate your credibility across institutions, enterprises, and investors.

MultiversX (xPortal)

Launched in 2023, xPortal combines a Web3 wallet, NFT/crypto transfers, debit card, encrypted messaging, AI avatars, dApp portal, and metaverse features.

In January 2025, xPortal acquired Alphalink, enhancing its AI-powered user experience.

Regional and Industry Platforms

Blockbank/Utorg, Jambo (Africa), Mara (Nigeria/Kenya), Rappi (LatAm), Telefónica’s TU Wallet (Spain), MoonPay, and Securitize all integrate wallets, payments, DeFi, credit, NFT functionality, and compliance tools.

Each is executing the super-app model regionally, tailoring infrastructure and services to local market needs.

Why It Matters in 2025

Streamlined User Journeys: From sending money to trading assets to tipping creators. No app-jumping required.

Platform Stickiness: Embedding services creates a data flywheel powering AI personalization and deep engagement.

Regulatory Readiness: Licensing (e.g. X, Robinhood, Coinbase) builds compliance-backed legitimacy.

Crypto Adoption Pathways: Onramps through social and finance apps catalyze mainstream Web3 access.

Competitive Realignment: Fintech incumbents face a challenge from crypto-native platforms building stronger ecosystems.

👉 Get your brand in front of 20k+ industry leaders. Advertise with us.

Future Outlook & Actionable Insights

Social + Finance Integration: Platforms with engaged user bases (e.g. TikTok, Discord) should explore embedding payments or enabling creator monetization.

APIs + Third-Party Mini-Apps: Build modular backends or mini-app frameworks enabling external innovation (e.g. social tipping, NFTs, DeFi).

Regulatory Strategy: Secure broad licenses early (money transmitters, custody, card issuing) to enable rapid expansion.

AI-Powered Personalization: Use behavioral data across services to tailor suggestions (e.g. investing tips, coupon deals, engagement nudges).

Emerging Market Focus: Prioritize mobile-centric markets with low legacy banking to achieve swift adoption.

Key Risks Ahead

Regulatory uncertainty in the U.S./EU, especially for tokenized assets and crypto custody.

Execution complexity: Building user-friendly, cross-functional super-apps requires substantial multidisciplinary coordination.

Trust barriers: Platforms like X must maintain robust data privacy and financial reliability post controversies.

Fragmentation risk: Without seamless design, the user experience could fragment rather than integrate.

Get in front of businesses. Go from unknown to unstoppable.

We help blockchain and AI startups earn institutional trust, craft strategic positioning, unlock high-value partnerships, and drive sales.

Curious what that could look like for your company?

Final Take

2025 is shaping up as the year super-apps enter the crypto domain in earnest. From X’s wallet and payments, Coinbase’s DeFi layering, Robinhood's tokenization, to regional champions like xPortal, the blueprint is clear: unite payments, investing, social, identity, and blockchain services within one platform.

The roadmap ahead? Build modular, compliant, AI-infused ecosystems that Mainstream consumers rely on daily, the ultimate leverage for user engagement and financial sovereignty.

Are you a founder in fintech or Web3? Or an investor tracking super-app plays? I’d love to explore possible use cases in your market. Let’s connect.

📣 Stay Connected

We’re here to decode complex Web3 and AI trends and turn them into actionable insights.

Forward this newsletter: Know someone shaping AI, RWA tokenization, stablecoin and digital asset space? Send this along and connect us.

Until next time!

Marta